Owing to its huge dependence on

crude oil, India’s macro-economic factors are majorly depend upon crude prices.

Indian rupee is no exception in this regard, so when global crude prices slump

in second half of 2014, Rupee entered into a great period of low volatility.

Indian rupee joined the top 5 performing EM currencies from fragile five in

2013.

Surge in Volatility: A Reality!

Weekly Realized

Volatility of USDINR

As above chart shows weekly realized

volatility of USDINR pair. For calculating realized volatility weekly return on

closing basis considered and standard deviation from 12 week moving average is

considered. A closer look to above chart, shows rupee had been in a period of

low volatility from Jan-14 to Aug-18. During this period volatility remained kept

1% level and at times fell to 0.4% also.

Weekly Range of

USDINR

To compare volatility

in recent past, Weekly range, difference of high and low, of USDINR pair is

compared. During FY-15 to FY18 there has been 5 instances of more than 2% weekly

range, same as in FY-19. The below chart shows, % of weeks with more than 1%

weekly range. While FY-15, FY-16 witnessed 45% weeks with more than 1% weekly

range and FY-17, FY-18 witnessed 25% weeks with more than 1% weekly range. But

FY-19 is a clear outlier as nearly 75% of weeks witnessed more than 1% weekly

range.

This long period of low volatility

can also be attributed to RBI’s management during this period. Dr. Raghuram

Rajan believed India need to have a ‘Bullet Proof’ balance to manage global turmoil’,

hence RBI’s forex reserve grew substantially from USD 277.1 Bn in September

2013 to USD 400 Bn August 2018. RBI regularly intervened in FX markets to

absorb foreign inflows, keeping large gains in Rupee at bay. Though, RBI was

net buyer during the period, but it was actively intervening both sides keeping

volatility artificially low. It is note-worthy that RBI was cautious about

imported inflation thus kept sudden depreciation of rupee under check.

Due to relatively stable USD/INR

move and high forward premiums have induced a passive hedging in market participants.

While receiving premiums, exporter tends to hedge long-term in expectation of

stable rupee and Importers tends to delay long-term hedge as they have to pay

high forward premium. For importers the decision to hedge or not depend a lot

on its residual maturity.

USDINR Forward Premium: Steady Decline a game changer!

As shown in the figure below, 1

Year forward premium in USD/INR has seen steady declined owing to change in

interest rates in both economies, India and US. 1 Year annualized forward

premium declined from 6.50% in October-15 to 4.00% in Dec-2018. Going forward,

USDINR forward premium might decline further amid expectation of interest cut

in India in the next fiscal.

Fig: 1 Year Annualized

Forward Premium of USDINR

The decline in forward premium

and a surge in volatility in USD/INR should ideally nudge market participant towards

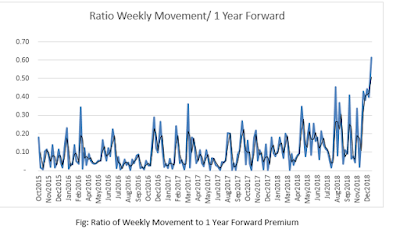

more active hedging policies. To ascertain the point the further, ratio of Weekly

movement and 1 year forward premium is analyzed.

Ratio: Mod(% Weekly movement)/ 1

Year annualized premium

The modulus of weekly movement is

taken to keep ratio positive, so this ratio only compare weekly movement vs 1

year forward premium.

Fig: Ratio of Weekly

Movement to 1 Year Forward Premium

As

above chart suggest, Up-until end FY-18 ratio

remained relatively low b/w 0.05-0.2, which means every week movement is just

20% of 1 year forward premium. But due to recent increase in volatatlity and

declining forward premium, the ratio has seen a significant jump. The ratio has

even spiked to above 0.5 levels, which mean weekly movement is as high as 6

month forward premium.

With

steady decline in forward premium and recent surge in volatility, it is safer

to argue that now forward premiums should have little say in USDINR forward hedging

strategies. The decision of hedging currency risk should not be affected by it

residual maturity.