Majority

of Indian Population is rural poor or urban middle class/poor, who continued to

struggle for two ends meal. As income sources are limited, most of Indian are

price sensitive thus wary of inflation. Consequently, political parties pay deep

attention to inflation phenomena and build their campaign around it. It is

note-worthy that Late Atal Ji had to resign due to high onion prices and BJP

build their political campaign around rising prices in 2014. In line with

global practices, India releases its consumer prices index (CPI) and whole sale

price index (WPI) but unfortunately, general public access inflation by

political propaganda rather than ground reality.

What is Inflation?

Consumer

Price Index (CPI) measure changes over time in general level of prices of goods

and services that households acquire for the purpose of consumption. In simple

terms, CPI inflation is increase of cost of living. For example: If cost of

living increase from INR 100 to INR 105, it will mean inflation of 5%. CPI inflation

is most broad based measured of inflation, which is based on spending habits of

Indian consumer.

Chart-1: Rural CPI Index

Above

chart depicts, weightage of various consumption goods and services of rural

India. As you will see, Food and Beverage has weightage of nearly 54% and

Miscellaneous has 27%, which includes health, transportation, education and

personal care. It is note-worthy that CPI index is based on actual spending

habit of an average consumer and tends to updated frequently. In simple terms, Rural CPI gives more importance of increase in Food prices than increase in cloth prices. Obviously, because food expense more critical than cloths.

Chart 2: India CPI Index

Above

chart depicts, weightage of various consumption goods and services of urban

India. As you will see, overall India spends nearly 46% food and beverages and

28% on miscellaneous products, which include Health, Transportation, education

and personal care. It is also note-worthy that fuel also represented nearly 7%. In simple terms, if common Indian spends INR 7 on fuel than she will spend nearly INR 46 on food, hence price rise of food is far more important than fuel price rise. This is does not mean that fuel prices hike does not have any impact but it means one should look at overall increase in cost of living to judge true impact of price rise.

Inflation under UPA:

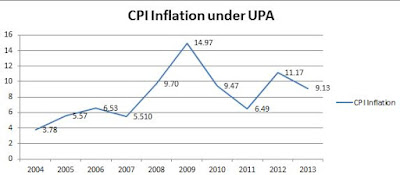

Chart-3: Average Price Rise under UPA

Above

chart depicts UPA inherited lower inflation levels below 4%, but could not

retain inflation under control. It is note-worthy that UPA government lost

control after 2008 crisis and never able to get it back in control. UPA

government maintained lax fiscal policies and stand still decision making aggravated

supply side bottlenecks, which lead to further rounds of inflation. In simple terms, inflation in UPA II was well above 9%, which means cost of living was increased from 100 to 109 within a year.

Rather

than supporting RBI in lowering inflation – UPA government was in war of words

with RBI, pushing to reduce interest rates. Former, RBI Governor, Subbarao then

said –“ You cant bring it down without some sacrifices in growth, inflation is

a very regressive tax it hurts poor people more than relative better off

people. The voices hundereds of millions of poor people is not heard through

media.”

Inflation under Modi

Government:

Chart 4: CPI Inflation under Modi Government

India’s

CPI inflation eased sharply under Modi government and remained below tolerance

zone. As chart depicts, India’s CPI inflation was above 8.3%, when Modi

government took charge of office. Eversince, CPI inflation has tested low of

1.46% in June 2017 and remained well under control with last reading 3.77% in

September 2018. In simple terms, price rise has moderated under Modi government, which took various key measure reign inflation

expectations such as improvement on supply side bottlenecks, better management

of crops, controlled fiscal deficit and structured reforms.

Role of Central Bank

Global

central banks tend to have inflation targeting mandates, wherein they adjust

their monetary policy to contain inflation towards desired levels. For example-

In high inflation scenario central banks increase interest rates to make

borrowing costly and reduce easy money supply in economy. Higher borrowing cost

lead to lower demand, which in turn reduce inflation. Modi government have

legally mandated RBI to keep CPI inflation in a target range of 2-6%. As per

mandate – Monetary policy will be decided by 6 member committee, which will try

to keep inflation under check. This fiscal RBI has raised interest rates twice to battle rising fuel prices. RBI’s role is further underscored by active liquidity management to keep money supply to desired levels.

It

is note-worthy interest rate regime has little impact on food inflation, which

is largely depend on supply side bottlenecks. Former RBI governor, Raghuram

Rajan has lauded government’s effort in this regard. Recent upswing crude oil prices has surged the petrol prices, which in turn impact fuel inflation. PoliticSal parties has started to fuel the propoganda, citing INR 90 fuel prices. But a closer look overall increase in inflation paint vary different picture. In September 2018, CPI inflation was at 3.77%, which means the cost of living increase from INR 100 in September 2017 to 103.77 September 2018. Clearly, rising fuel prices are worrisome sign but they are yet impact common man.

At last, this blog just

want to put forward facts regarding price rise and explain reader that one

should not fall prey to political propaganda.

Reference:

Reference:

- https://www.numberbasket.com/india/economy/cpi/consumer-price-index-weights-table

- https://dbie.rbi.org.in/DBIE/dbie.rbi?site=home

- https://www.inflation.eu/inflation-rates/india/historic-inflation/cpi-inflation-india.aspx

- https://economictimes.indiatimes.com/news/economy/policy/duvvuri-subbarao-responds-to-p-chidambaram-says-inflation-hurts-poor/articleshow/21541055.cms

No comments:

Post a Comment